ATTENTION: For Those who are serious about Taking your Real Estate Investing to the next level...

Here's The "10 X 10" VALUE You'll Get...

In Our Coaching MASTERMIND

You'll Discover what It Takes to Run a BOOMING, profitable

Real Estate Investing business...

ONLY $1.00 FOR YOUR 1st MONTH

10X10 VALUE #1:

90 Minute LIVE Every Month

10X10 VALUE #2:

90 Minute LIVE "DEAL CALL"

Every Month

00Hours00Minutes00Seconds

10X10 VALUE #3:

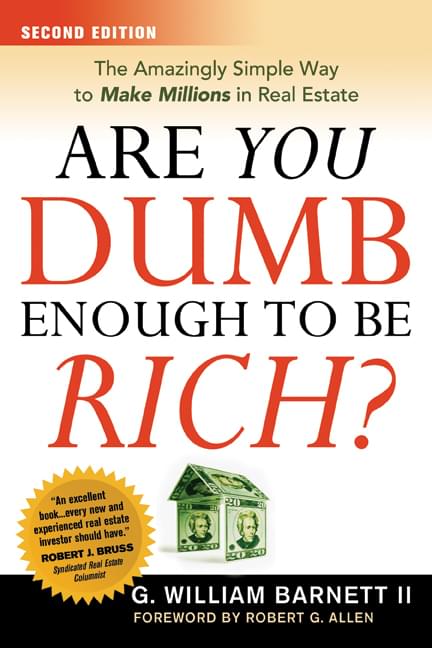

A Copy of my National Best Seller

A FREE Kindle copy of my National Best Selling book, that's the direct result of over 28 years of investing and helping thousands of investors across the country go over, around and through the barriers holding their real estate investing back!

Copyright © 2020 - The NOW! Real Estate Network, LLC